Unlock Financial Possibilities With a Home Equity Loan

Homeownership offers a realm of monetary opportunities past just providing a roof over one's head. Consider the possibilities that exist within making use of a home equity loan. This economic tool supplies a method to take advantage of the equity you have actually built in your home for different purposes. From making home improvements to consolidating financial obligation, the potential advantages are various. As we check out the auto mechanics and advantages of home equity lendings, you may discover a course to unlocking covert monetary possibility that could improve your monetary landscape.

Benefits of Home Equity Finances

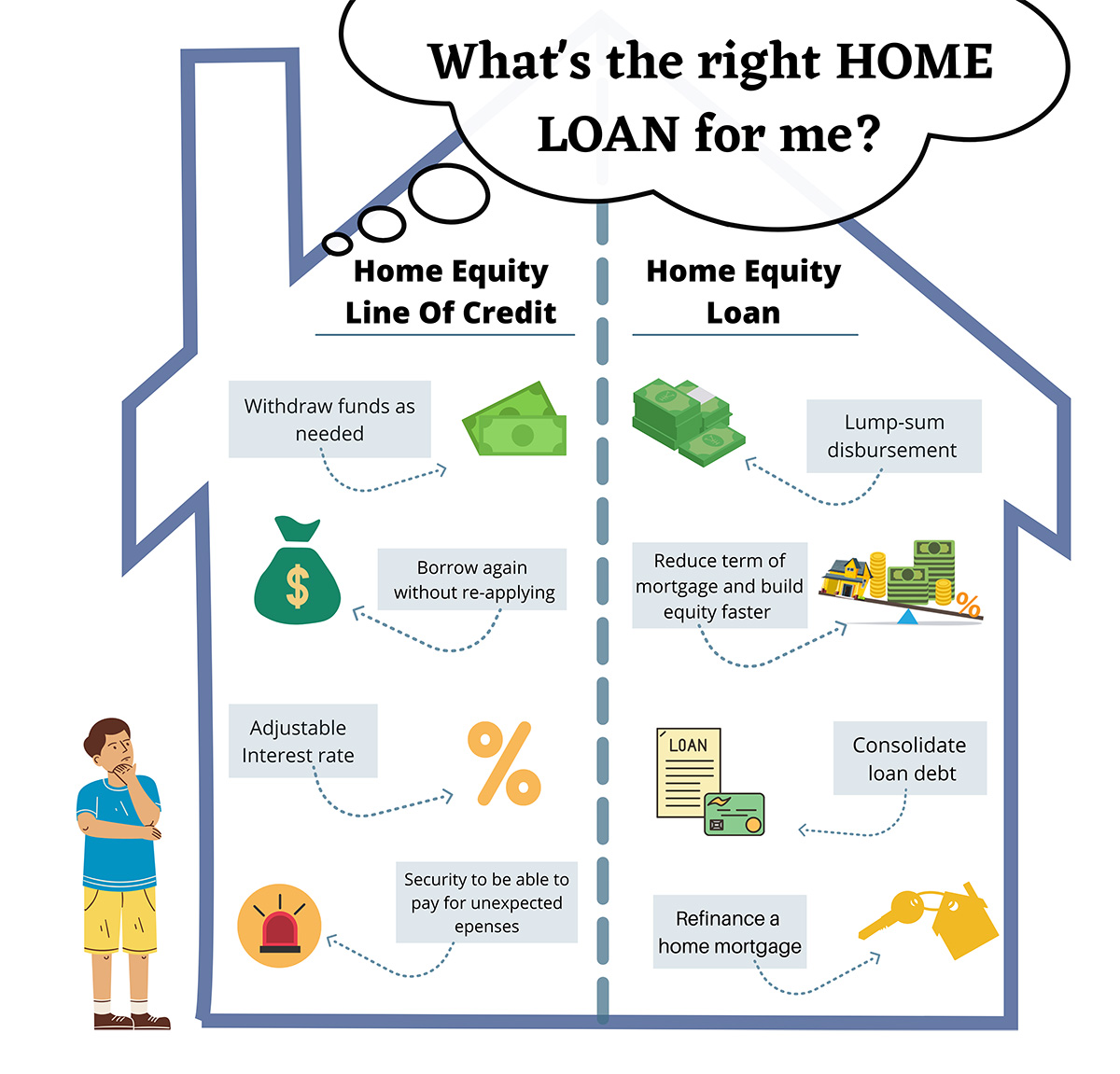

Home Equity Lendings use homeowners a adaptable and sensible financial option for leveraging the equity in their homes. Among the key benefits of a Home Equity Finance is the ability to access a large sum of cash upfront, which can be made use of for various purposes such as home enhancements, financial debt consolidation, or funding major costs like education and learning or clinical bills. Home Equity Loan. In Addition, Home Equity Loans typically include reduced rate of interest compared to other types of car loans, making them an economical loaning choice for home owners

Another advantage of Home Equity Loans is the prospective tax obligation advantages they supply. In many cases, the interest paid on a Home Equity Car loan is tax-deductible, offering house owners with a possibility to conserve cash on their tax obligations. Moreover, Home Equity Finances commonly have much longer settlement terms than other kinds of finances, permitting debtors to spread out their payments over time and make handling their financial resources much more manageable. Generally, the benefits of Home Equity Lendings make them a valuable tool for homeowners seeking to open the economic possibility of their homes.

:max_bytes(150000):strip_icc()/home_equity.asp-final-59af37ca6ebe48f3a1e0fd6e4baf27e4.png)

Exactly How Home Equity Loans Work

Provided the considerable advantages and advantages detailed relating to leveraging the equity in one's home, recognizing the technicians of exactly how equity financings run comes to be critical for home owners looking for to make enlightened monetary decisions. Home equity fundings are a sort of finance in which the debtor utilizes the equity in their home as collateral. Equity is the difference in between the evaluated value of the home and the exceptional mortgage balance.

When a homeowner applies for a home equity financing, the loan provider reviews the value of the home and the quantity of equity the consumer has. The interest paid on a home equity funding might be tax-deductible, making it an attractive choice for house owners looking to fund major costs or settle high-interest financial debt. Understanding the terms, payment structure, and possible tax obligation benefits of home equity fundings is crucial for property owners considering this monetary choice.

Utilizing Home Equity for Improvements

Making use of the equity in one's home for remodellings can be a strategic economic move that not just improves the living space however likewise adds value to the home. Home equity car loans provide property owners the opportunity to access funds based upon the worth of their residential property past the impressive home loan balance. When taking into consideration improvements, leveraging home equity can supply an economical service contrasted to various other forms of loaning, as Alpine Credits Equity Loans these finances usually provide reduced rate of interest as a result of the collateral provided by the building.

:max_bytes(150000):strip_icc()/dotdash-mortgage-heloc-differences-Final-6e9607c933e9467ba4d676601497a330.jpg)

Consolidating Financial Debt With Home Equity

When taking into consideration monetary techniques, leveraging home equity to consolidate financial debt can be a prudent option for people seeking to streamline their settlement responsibilities. Consolidating financial debt with home equity includes taking out a financing utilizing the equity developed in your house as collateral. This approach enables borrowers to integrate multiple financial debts, such as charge card balances or individual finances, into one solitary payment. By doing so, people might take advantage of reduced interest prices offered on home equity finances compared to various other forms of financial obligation, possibly decreasing general passion costs.

Moreover, consolidating financial obligation with home equity can streamline the payment procedure by combining numerous settlements right into one, making it less complicated to avoid and manage finances missed payments. It also has the potential to improve credit report by minimizing the total debt-to-income proportion and demonstrating responsible debt management. However, it is crucial to carefully consider the threats entailed, as failure to pay back a home equity car loan could lead to the loss of your home via repossession. Consulting with a financial expert can assist determine if settling financial obligation with home equity is the right selection for your monetary situation.

Tips for Safeguarding a Home Equity Funding

Protecting a home equity finance needs precise preparation and a comprehensive understanding of the lender's needs and analysis standards. Before applying for a home equity lending, it is important to assess your economic circumstance, including your credit history score, existing financial debt commitments, and the amount of equity you have in your home - Alpine Credits Equity Loans.

Look for affordable rate of interest prices, beneficial lending terms, and reduced costs. By demonstrating monetary duty and a clear understanding of the lending terms, you can improve your opportunities of securing a home equity funding that straightens with your needs and goals.

Verdict

To conclude, home equity car loans use a variety of advantages, consisting of the ability to access funds for remodellings, financial obligation combination, and various other economic demands. By leveraging the equity in your house, you can open brand-new opportunities for handling your financial resources and accomplishing your goals. Home Equity Loan. Recognizing just how home equity financings job and adhering to ideal techniques for protecting one can assist you maximize this important monetary tool

Home equity loans are a kind of funding in which the borrower utilizes the equity in their home as collateral (Alpine Credits). Combining financial debt with home equity involves taking out a financing utilizing the equity constructed up in your home as collateral. Before using for a home equity car loan, it is important to analyze your financial circumstance, including your credit rating rating, existing debt commitments, and the quantity of equity you have in your home